Arbitration

May 2021

Amendment to Indian mining law

August 2023

US$13.6m Funding Notice from LCM

October 2023

Dismissal by High Court of Rajasthan

December 2023

Notice of Dispute

June 2024

Notice of Arbitration

September 2024

Constitution of Tribunal

December 2024

Statement of Claim

Current

LCM Financing

US$13.6 million Non-Recourse Facility

- Primary mineralisation is near-surface with the potential to develop a large, low-cost, bulk mineable open-pit operation;

- Metallurgical test-work indicates not metallurgically refractory;

- Panthera has not had the opportunity to test the full resource potential of Bhukia;

- Two separate resource calculations already published (based on different data sets):

- 1.74Moz – internationally recognised JORC compliant resource (2007) by Golder Associates (21 drill holes);

- 7.3Moz –Geological Survey of India (155 drill holes).

- Existing Panthera JORC-compliant resources estimate of 1.74Moz covers only 10% of the project area;

- Panthera original JORC resource were completed using $500/oz gold price, vs current spot prices at ~1800/oz => material expansion of reported resource expected;

- US$13.6m arbitration financing by to LCM – arbitration claim against the Republic of India under the Australia-India Bilateral Investment Treaty of 26 February 1999 (ABIT).

Bhukia Gold Project

A global Tier 1 Undeveloped Gold Project

- Primary mineralisation is near-surface with the potential to develop a large, low-cost, bulk mineable open-pit operation;

- Metallurgical test-work indicates not metallurgically refractory;

- Panthera has not had the opportunity to test the full resource potential of Bhukia;

- Two separate resource calculations already published (based on different data sets):

- 1.74Moz – internationally recognised JORC compliant resource (2007) by Golder Associates (21 drill holes);

- 7.3Moz –Geological Survey of India (155 drill holes).

- Existing Panthera JORC-compliant resources estimate of 1.74Moz covers only 10% of the project area;

- Panthera original JORC resource were completed using $500/oz gold price, vs current spot prices at ~1800/oz => material expansion of reported resource expected;

- US$13.6m arbitration financing by to LCM – arbitration claim against the Republic of India under the Australia-India Bilateral Investment Treaty of 26 February 1999 (ABIT).

LCM

Leading Litigation Financier

- More than 25 years in the business of financing dispute resolution;

- Listed on AIM – Market capitalisation of £137 million (26 April 2024);

- Approximately A$500 million in funds under management;

- Approximately 500 financing applications per annum with ~3% approved for funding;

- Since 1998, LCM have funded 244 disputes, all but 11 have been successful;

- Highly experienced in arbitration financing including GreenX Metals and Indiana Resources.

Arbitration

An Independent Process

- More than 25 years in the business of financing dispute resolution;

- Listed on AIM – Market capitalisation of £137 million (26 April 2024);

- Approximately A$500 million in funds under management;

- Approximately 500 financing applications per annum with ~3% approved for funding;

- Since 1998, LCM have funded 244 disputes, all but 11 have been successful;

- Highly experienced in arbitration financing including GreenX Metals and Indiana Resources.

Historically Positive Outcome

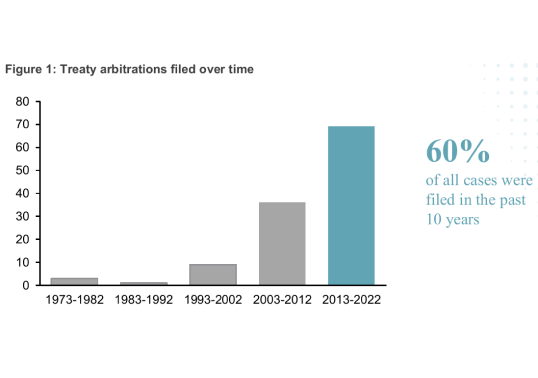

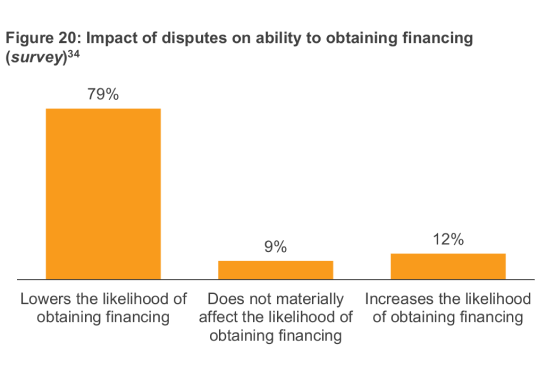

Mining Dispute Landscape

Rising commodity prices, COVID-19 pandemic, and transitions in political regimes have placed the mining sector at the center of … recent wave of resources nationalism

Get in Touch

Contact us

Leave the number and we will call you back